Red Forex (www.redstarfx.com) Red Star Forex Review and Red Star Forex PAMM Service

Our Favorite Fib is a Fibonacci-based system that exploits energy. It tends to be utilized on different time allotments and markets, including FX majors, stock records and items, giving the merchant unlimited chances. The procedure could be utilized, for instance, after some major financial news – in a perfect world, at the prior phases of the move following the news. However, in the event that the news just purposes a restorative rally or auction inside a built up incline, at that point this methodology won’t function too. In this manner it is suited for business sectors that are in a reasonable solid pattern e.g. at the point when cost is setting aside a few minutes or multi-year/month highs or lows.

TIME SPAN

The higher the time span, the more viable the F/F system works. It is commonly utilized on 1 or 4 hour time periods; albeit some of the time it could be connected to the day by day time span, as well. The most limited time span that one can utilize this is system on is around 15 minutes. Be that as it may if the exchange depends on a higher time span, at that point it is a smart thought to zoom in to a 5-minute outline keeping in mind the end goal to refine passage.

PARTS OF THE SYSTEM

The F/F technique depends on some Fibonacci retracement and augmentation levels. These are the 38.2% and half retracement levels (the last mentioned, actually, isn’t a Fibonacci level), and the 127.2%, 161.8% and 261.8% Fibonacci augmentation levels.

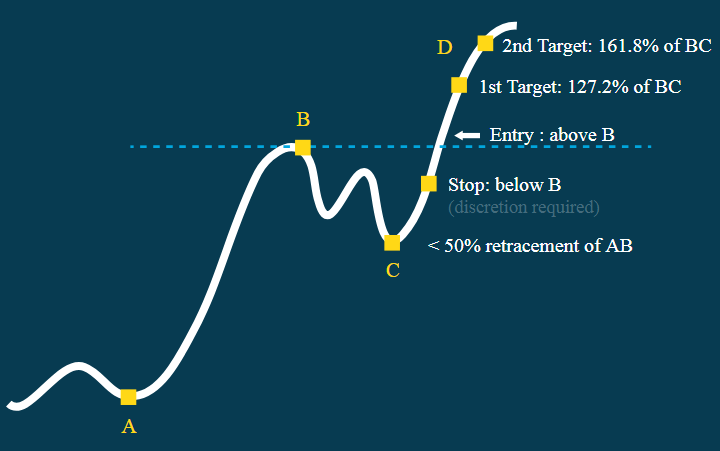

To see how the procedure functions, suppose that following a solid upward move (e.g. from indicate A B), the market follows a bit (to point C) on account of benefit taking as well as best picking, before proceeding in the first course (past point B). This methodology requires 3 value swings – the move from indicate A B, B to C (remedy), and C to D (augmentation). Here is the means by which a F/F purchase procedure would normally resemble:

In the F/F technique, we are keen on some piece of the CD leg of the move – the bit past point B, where passage is based. The benefit target would be dictated by a Fibonacci expansion level of the BC move (more on this beneath).

One condition for this methodology to function admirably is that we require energy. By definition, this infers point C ought to speak to a shallow retracement of AB, and after that a continuation in the first bearing, past point B. In this way, if cost backtracks over half, or a lot of time slips by, before it breaks point B, at that point the passage flag would not be substantial.

At the end of the day, for ideal passage flag, we require a solid move from indicate A point B; a moderately fast and shallow retracement of under half to point C, and afterward a continuation towards point D.

When point C is set up, the majority of the procedure’s parameters can be resolved.

To learn more about Red Star Forex and Our Favorite Fib, click on www.redstarfx.com. Get expert guidance from the experts of the industry. Open your trading account and succeed in the Forex market.

Register with us and subscribe to our RED STAR FOREX PAMM service to earn steady profits.